Getting individual investors to engage in the investment policy and asset allocation process remains a major challenge. For many individual investors (and their advisors), there might be a shortcut. Individual Investors could mimic institutional investors and use pension plan portfolios as a guide when constructing and maintaining the core of their own investment portfolio. Individual investors can leverage institutional investors' resources and planning work ? for free.

What works for institutions?

Pension plans live and breathe oversight. Behind-the-scenes work includes building a governance structure, and conducting an actuarial asset & liability modeling study from which an investment policy and plan-appropriate asset allocation can be developed. Then (only then) can a globally diversified investment portfolio be constructed. Institutional investors have significant resources, technology and expertise to develop strategy and do deep analysis. Importantly, those same resources then focus on continuous due diligence work.

The end result is a globally diversified asset allocation pie. A large balanced fund.

Can individual investors apply some of the same practices?

For those disappointed and disillusioned individual investors as they open their year-end portfolio statements and ask themselves 'what now?,' one way to a better investment experience is to piggyback off the work of institutional investors simply by constructing the core of their portfolio to look similar to that of a pension plan. Use a pension plan as a guide.

Many institutional investors, like pension plans, seem to endure and survive most all types of investment markets. In contrast, many individual investors' portfolios are devastated by similar investment environments. An individual investor's retirement income objectives look similar to an institutional investor's obligations. An individual investor's retirement investment portfolio can be (and ought to be) viewed as a de-facto personal pension plan. Institutional and individual investment portfolios should look similar too.

Individual investors need not replicate any pension plan in particular. They simply have to mimic a pension plan. The objective would be to get into the same asset allocation ballpark as the average pension plan.

For the individual investor, mimicking a pension plan is easier today given the availability of index funds and ETFs which offer exposure to (nearly) all asset classes, regions, currencies and sectors. The result can be a low-cost, broadly and globally diversified portfolio that looks like a personalized pension plan (while not assuming individual stock risk, but that's another article entirely).

Which pension plan(s) to mimic?

When looking for a benchmark institutional investment portfolio, the individual investor has plenty to choose from.

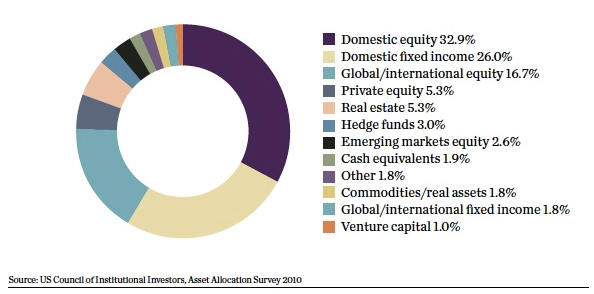

A U.S. investor might mimic the average asset mix of U.S. corporate, public and union pension funds.

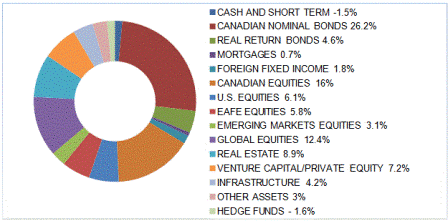

A Canadian investor could use the Pension Investment Association of Canada (PIAC) average asset allocation which is a composite of "130 Canadian pension funds that manage assets in excess of $1 trillion on behalf of millions of Canadians." As a composite, PIAC's allocation represents an asset allocation for the average individual investor.

PIAC's asset allocation:

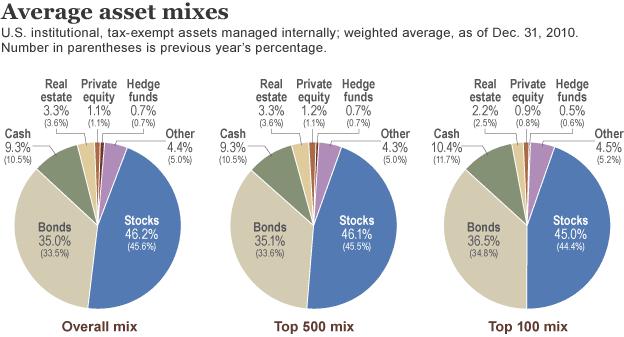

Or the average asset mixes of the largest U.S. institutional money managers.

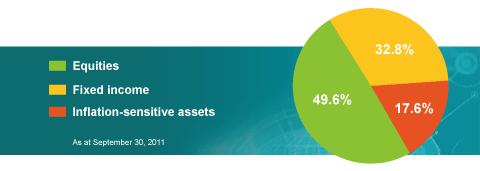

Others might choose to mimic the Canada Pension Plan.

Observations

A bond allocation of about 1/3rd is a common theme across most all institutional investment portfolios. PIAC 35%. CPP 33%. U.S. 28%-35%. (Hmm ? what should that tell individual investors)? Further, the PIAC bond allocation has not changed much over time. 2000 (33%), 2005 (32%), 2010 (35%). (Again, hmm).

Many institutional asset allocations are similar. Different but similar. If an individual investor's investment portfolio doesn't look 'something like' a pension plan, then ? why? Why would it look significantly different? Not the same. But similar. If an individual's retirement portfolio doesn't approximate that of the average pension plan, then is it time to re-visit their strategy?

A Starting Point

Shortcuts are shortcuts. The benchmark examples I used are based on the general pension plan population and as such are, well, general. The asset mixes are averages. For any individual investor in particular, they will not likely be the answer. But for some, they might be an answer. They may not be the preferred or perfect solution for many. But using an institutional investor/a pension plan as a guide is a starting point and better than having no plan, no strategy or no guide at all.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

death race internal revenue service huntington disease new world trade center west memphis three shaun white game of thrones season 2 trailer

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.